Home > News

The domestic acetone market has shown a clear downward trend in prices. The global acetone market is influenced by weak demand in Europe and oversupply in Asia, with Saudi CP prices falling by $55 per ton, directly weighing on domestic market expectations. Although China's anti-dumping policy expired in June, imported supplies from Taiwan and South Korea have not significantly increased, and international low-priced cargoes continue to pressure the domestic market.

The upstream pure benzene price has dropped sharply, with the average price of pure benzene in East China in the first half of 2025 declining by 22.62% year-on-year, weakening cost support for phenol. Despite phenol's relatively resilient pricing, the phenol-acetone industry remains near the breakeven line. Domestic phenol-acetone plant operating rates have stayed at 80%, and with the restart of Shenghong Petrochemical and Wanhua Chemical units, operating rates may rise to 90% in September. Acetone production increased from 270,000 tons in August to 300,000 tons, exacerbating supply-side pressures.

While capacity utilization has improved, supply-demand imbalances persist. Weakness in downstream sectors such as real estate and automotive has slowed growth in major demand areas like bisphenol A and methyl methacrylate (MMA). Terminal solvent demand has slightly recovered as temperatures cool, but overall incremental growth remains limited. Traditional solvent demand remains stable, but slow growth in new applications (e.g., aliphatic water reducers) has failed to offset weakness in core demand sectors.

Under the triple pressures of oversupply, falling costs, and weak demand, acetone prices continue to trend downward. Declines in upstream raw material prices have eroded cost support, while sluggish demand growth in downstream bisphenol A, MMA, and other industries, coupled with a surge in imports, has collectively pressured the market. In the short term, prices may remain weak and rangebound, but attention should be paid to potential impacts from pre-holiday stockpiling demand ahead of the two festivals and international market dynamics on supply-demand balance.

The domestic market price of methyl ethyl ketone (MEK) is showing a trend of regional convergence, with current ...

Read More

Ethyl acetate in East China, affected by plant maintenance, some enterprises have slightly raised prices. In Sou...

Read More

The domestic acetone market has shown a clear downward trend in prices. The global acetone market is influenced ...

Read More

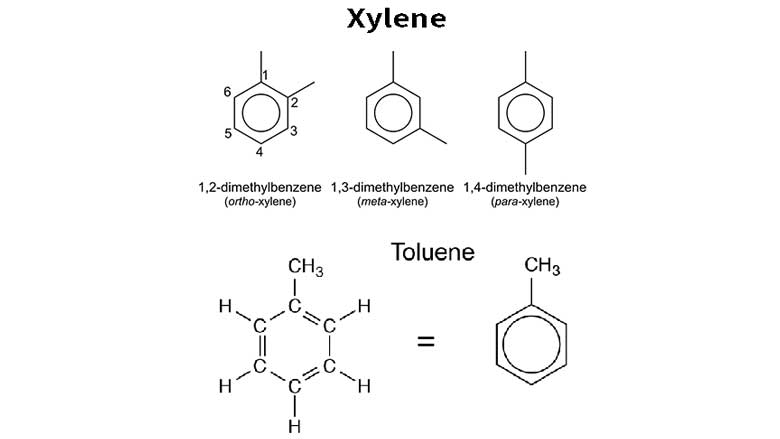

As of August 15, 2025, the aromatics product market exhibits characteristics of price differentiation and supply...

Read MoreLeave your message and we will get in touch with you as soon as possible.